- 22 January 2024

Bring back mum and dad investors

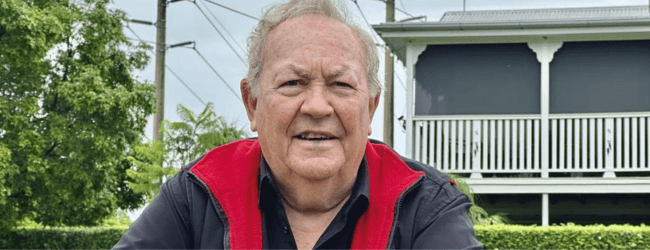

The Courier Mail: Des Houghton

Rental housing shortages are a direct result of unnecessary state and federal government interference in the market, says a Queenslander described as Australia's most successful property investor.

And Kevin Young believes the crisis could be solved quickly and simply by removing the banking and taxation obstacles that forced mum and dad investors to shy away from investing in rental properties.

He said he warned of the looming rental crisis in 2015 after regulators tinkered with banking rules around interest-only loans investors could claim as tax deductions.

"I saw it coming and said so, but nobody was listening," said Young the founder of PropertyClub which was described recently at a parliamentary inquiry as the largest member-based property investment group in Australia with 70,000 members.

He gave evidence recently to the select committee cost of living inquiry. There he blamed the Australian Prudential Regulation Authority for wrecking the market in a misguided mission to protect banks that didn't need protecting.

APRA "torpedoed the property market", he told the inquiry. "During 2015 APRA decided to change the lending rules for landlords by instructing the bank to impose major restrictions on interest-only loans," he said in evidence.

"A key part of this policy was to impose a time limit on interest-only loans, after which they would revert to principal and interest loans. Banks moved quickly to force the principal and interest loans even before that time period had finished.

"There was no grandfather clause, which meant that from 2015 thousands of landlords were immediately faced with huge increases in their mortgage repayments. "This sent a huge shockwave through the mum and dad property investment market, from which it has never recovered."

The decision caused a shortage of rental accommodation at the lower end that persists today. Low-income workers were the worst hit. Tent cities springing up in Queensland and other states are a direct result of this interference, he said.

It's not the fault of banks, Young said. He told the inquiry he knew about the problem from the ground up because he had skin in the game.

"I was the biggest investor in Australia," he said.

"I had 185 city properties around Australia, and now I've got about 30." The changes forced the banks to ask him for "unrealistic" increases in mortgage repayments. When e discussed with his lenders how he might meet the new principal pls interest repayment rules, he was given a one-word answer: "Sell."

"So I sold a lot of properties. I kicked a lot of mum and dad owners out. The only people that could buy the properties were owner-occupiers." He said then-treasurer Scott Morrison made it worse with "bureaucratic bungling" in his 2017 Budget shortly before he became PM.

"The Budget removed the ability of landlords to claim depreciation benefits on older established properties, "he told the inquiry. "unfortunately, the implications of this policy were not through through. It created a disincentive for property investors to buy established properties that offer lower rents.

Rather, the new policy was an incentive for investors to buy or build new properties that have higher rents. "This seemingly small tax change in the 2017 budget had huge implications for the renal market." He said new builders were not a practical solution for low-income workers who couldn't afford them.

Nor could they wait three years or more for them to be built. Young is appalled by the Greens and the left wing of the Labor Party who seem to have a visceral hatred for landlords - the very group of investors he says can fix the problem.

The Palaszczuk-Miles government in Queensland made it worse by tenancy law changes demonising landlords nad making it difficult for them to evict bad tenants. Investors were also scared off by Labnour's proposed land tax changes and socialistic caps on rent.

Last year Premier Annastacia Palaszczuk was forced to scrap the proposed land tax changes after a savage backlash from investors and banks. But it was too late. The damage had been done with an REIQ survey showing investors losing confidence in investing in Queensland.

Young is also fed up with politicians of all persuasions who have a habit of reverse engineering the facts to put the blame somewhere else. And the lessons of history are quickly forgotten. As treasurer in 1985 Paul Keating got rid of negative gearing. It proved so disastrous for the rental market he was forced to restored it within two years.

But Young insists we don't have to be gloomy about future housing supply. As he told the inquiry: "The policies can be reversed. By reversing bad policy cheap rentals will flood back into the market. I think we've got a good chance of getting 250,000 more rentals into the marketing, most importantly, at no cost to the government.

"The supply problem cannot be solved with new properties, because by definition they have to be the dearest properties on the market, because you're paying current rates for labour and for goods that come into the property.

"The solution has to be the second-hand market. And yet the law stops us buying second-hand properties because they won't allow us any tax deductions. That happened back in 1985 with Keating."

This week we went for a stroll through his old stomping ground of Bulumba where he built and sold many homes in the 80s. We came across the deserted Bulumba Barracks site at Apollo Rd, Bulimba. The Shayher Group paid $63m for the 20ha riverfront site in 2019 and plans to build 855 homes there.

Young doesn't know anyone at the Shayher Group and has no investments nearby. Yet the idea of a significant development 5km from the CBD excites him. A masterplan shows parks, houses, townhouses and apartment buildings up to five storeys high. The site contains the heritage-listed Barges Workshop built by the United States military during World War II. It will be saved and enhanced.

Of course it is the perfect fit for inner-Brisbane. Young agrees. Then I tell him that many in the neighbourhood oppose it. Green activists have condemned the plans. Young rolls his eyes in dismay

Related Posts

The Real Problem Behind the Budget and the Solutions No One’s Talking About

Another Federal Budget, another round of promises. But once again, the people left behind are proper

- 31 March 2025

Property Headwinds Not As Bad As Feared says Clifford Bennett

Join renowned economist Clifford Bennett as he shares his expert analysis on the current state of Au

- 20 January 2025

Western Australia Tops Property Investment Growth In Australia

In good news for renters in Western Australia, the State has recorded a record level of investment b

- 11 June 2024